INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

Don’t Settle for Less — Trusted Commercial Fire Insurance Claim Public Adjusters

Commercial Fire Claim Specialists

Maximum Settlement in Minimum Time

Our licensed public adjusters work exclusively for you, never for the insurance company.

We help building owners and property managers of commercial buildings, industrial and manufacturing facilities recover fair and prompt settlements after devastating fire losses.

Don’t let delays and underpayments derail your recovery. Schedule your strategic claim consultation today and protect your asset.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Don’t Settle for Less — Trusted Commercial Fire Insurance Claim Public Adjusters

Commercial Fire Claim Specialists

Maximum Settlement in Minimum Time

Our licensed public adjusters work exclusively for you, never for the insurance company.

We help building owners and property managers of commercial buildings, industrial and manufacturing facilities recover fair and prompt settlements after devastating fire losses.

Don’t let delays and underpayments derail your recovery. Schedule your strategic claim consultation today and protect your asset.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

20+

Years Experience

500+

Large-Loss Claims Settled

$250M+

Settled Property Insurance Claims

Commercial Fire Insurance Claim Experts

Fire damage in commercial buildings presents complex challenges—multiple tenants, safety concerns, structural losses, and potential business interruption. ICRS specializes in navigating these high-stakes claims. We protect your investment, advocate for your rights, and ensure you're not left covering losses out of pocket.

🔥 Commercial Building Fire Claims

We help owners and property managers of buildings, facilities, schools, and hotels recover from fire damage affecting one or multiple areas. Our team coordinates structural evaluations, mitigation logistics, loss of rent calculations, and detailed damage assessments

🔥 Business Interruption

& Loss of Rents

If fire damage has displaced tenants or halted operations in your facillity or warehouse, you may be entitled to lost rental income. We handle business interruption claims to help you recoup every dollar owed.

🔥 Fire Claim Help for

Property Managers

We understand the pressures management companies face after a fire—angry tenants, urgent repairs, and unclear insurance answers. Let us guide the process so you can stay focused on your residents and responsibilities.

Real Fire Results for Owners & Managers

Are You

Struggling With...

Are You Struggling With...

Initial Fire Commercial Claims

Filing a commercial fire claim is complicated. Don't go it alone. Early representation from ICRS ensures mistakes are avoided, recovery is accelerated, and your payout is maximized.

Underpaid Commercial Fire Claims

Insurance companies routinely undervalue complex claims. If your initial offer doesn't cover real costs, we’ll re-open the claim, document overlooked damage, and fight for fair compensation.

Denied Commercial Fire claims

Denied claim? Don’t walk away. Denials can be reversed with the right evidence and strategy. We specialize in turning “no” into “yes.”

Delayed Commercial fire Claims

Stuck in insurance limbo? We’ll push your claim forward and ensure timely resolution backed by policy language and state laws.

Why Choose ICRS Public Adjusters ?

No Recovery, No Fee Representation*

We don’t get paid unless you do.

Proven Results

Hundreds of millions in commercial and multifamily claims recovered.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We negotiate maximum settlements without jumping straight to court.

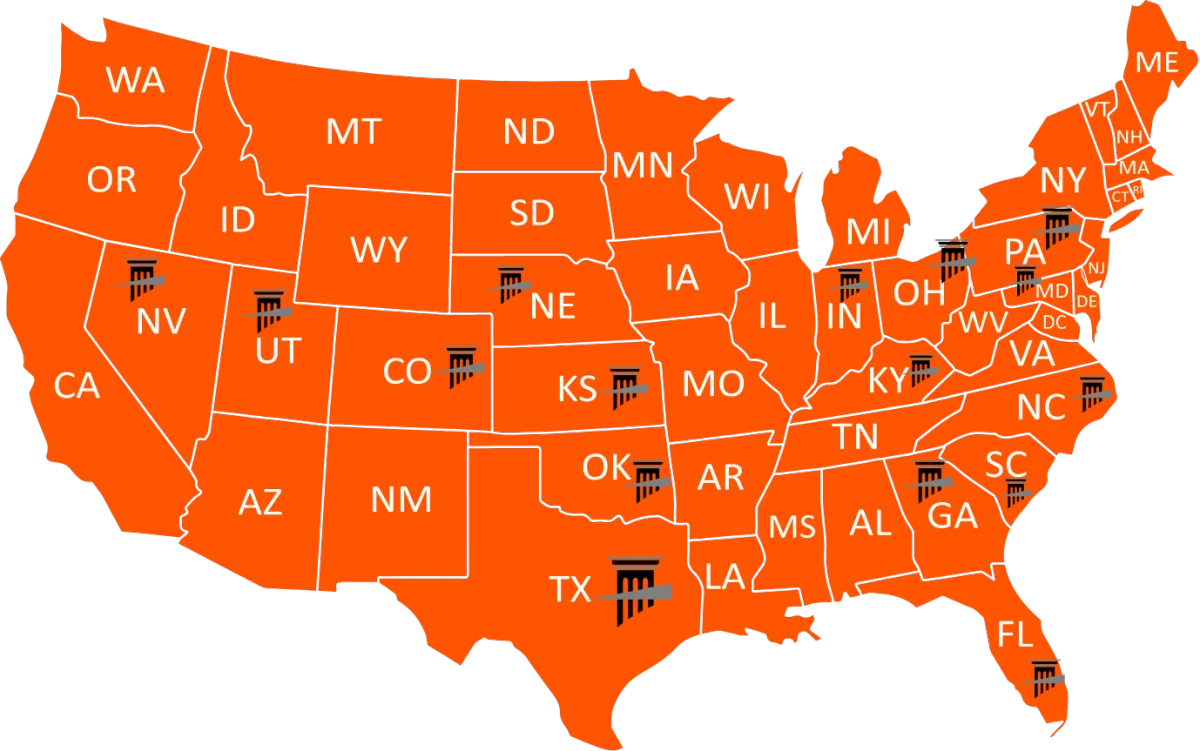

Licensed Nationwide

Serving policyholders in 16 states.

Verifiable Increases

We’ve boosted settlements by 20% to over 3,800% compared to initial insurance offers.

The Nations Leading Commercial Fire Damage Claim Specialists

Was Your Commercial Fire Claim Denied or Underpaid?

ICRS specializes in large-loss commercial building fire claims. We help you challenge bad-faith tactics, validate your loss with detailed documentation, and get the payout you deserve.

We Fight Insurance Tactics That Reduce Payouts

Storm and wind damage

Recover full compensation

Challenge low offers

Reopen and supplement claims

Provide forensic fire assessments

Schedule a Strategic Claim Consult Today

The Nations Leading Commercial Fire Damage Claim Specialists

Was Your Commercial Fire Claim Denied or Underpaid?

ICRS specializes in large-loss commercial building fire claims. We help you challenge bad-faith tactics, validate your loss with detailed documentation, and get the payout you deserve.

We Fight Insurance Tactics That Reduce Payouts

Storm and wind damage

Recover full compensation

Challenge low offers

Reopen and supplement claims

Provide forensic fire assessments

Schedule a Strategic Claim Consult Today

Licensed Public Adjusters In 16 States:

Commercial Fire Claim Specialist

Trusted Experts in Commercial Fire Damages Claims

Dealing with a complex commercial building fire insurance claim? Our IICRC-certified specialists are experienced in documenting all forms of fire-related damage—smoke, heat, water, and structural compromise—that insurance companies often overlook or minimize. We help apartment owners, investors, landlords, and property management companies secure the maximum insurance payout through thorough, defensible documentation.

Experts in Commercial Building Fire Insurance Claims

We Fight Denied & Underpaid Commercial Fire Claims

Detailed Fire Damage Reports That Strengthen Your Case

Commercial Fire Claim Specialist

Trusted Experts in Commercial Fire Damages Claims

Dealing with a complex commercial building fire insurance claim? Our IICRC-certified specialists are experienced in documenting all forms of fire-related damage—smoke, heat, water, and structural compromise—that insurance companies often overlook or minimize. We help apartment owners, investors, landlords, and property management companies secure the maximum insurance payout through thorough, defensible documentation.

Experts in Commercial Building Fire Insurance Claims

We Fight Denied & Underpaid Commercial Fire Claims

Detailed Fire Damage Reports That Strengthen Your Case

EXECUTIVE PUBLIC ADJUSTERS

Meet Our Public Adjusters

Meet Our

Public Adjusters

Scott Friedson

CEO | Public Insurance Adjuster

Scott formed Insurance Claim Recovery Support LLC aka ICRS, to help policyholders needing strategic and practical representation recovering from property damage insurance claims. Policyholders dealing with complex large-loss insurance claims can face many issues ranging from delays, underpayments, omissions, misrepresentations, or wrongful denials.

Commercial and Multifamily owners, property management companies and homeowner associations have received the results and benefits they deserve with Scott’s expertise while avoiding unnecessary litigation and appraisals.

As an active member in the multifamily, contractor, and public adjusting community, he has been a speaker at the apartment, storm restoration, general, and roofing contractor associations advocating what policyholders and management companies need to know about insurance claims. Scott holds public insurance adjuster licenses in Texas, Florida, Colorado, Georgia, Indiana, Kansas, Kentucky, Nebraska, South Carolina, North Carolina, Maryland, Ohio, Pennsylvania, Utah, Nevada, and Oklahoma.

He is also a Haag Certified Commercial Roof Inspector, Certified Appraiser & Umpire – CPAU, IICRC – Certified Water Restoration Tech with millions in successfully negotiated hail, fire, hurricane, tornado, flood, lightning, storm, business interruption, and other insurance claim settlements on behalf of his policyholder clients. Friedson retired as a Texas apartment real estate broker when he formed ICRS and has more than 30 years of combined experience in real estate as a broker, lender, apartment investor, and public insurance adjuster.

Misty Friedson

VP | Public Insurance Adjuster

With four years of dedicated experience as a licensed Public Insurance Adjuster, Misty brings a proven track record of successful claim resolution and unwavering advocacy for policyholders. Specializing in large-loss property damage claims, she has cultivated deep expertise in representing a diverse clientele that includes religious organizations, multifamily apartment owners, educational institutions, hotels, and homeowner associations (HOAs).

In addition to being a licensed public adjuster, Misty is a Haag Certified Commercial Roof Inspector known for her meticulous claim documentation, strategic negotiation skills, and steadfast commitment to maximizing fair settlements under the terms of the insurance policy. Her approach ensures that each client receives personalized service tailored to the unique complexities of their property and claim.

Having worked closely with faith-based institutions, historical buildings, and nonprofit organizations, Misty is particularly adept at navigating the nuances of policies covering sanctuaries, community centers, and auxiliary buildings. Her experience with multifamily and hospitality property owners has helped recover millions in damages from perils such as hail, fire, windstorms, and water intrusion—minimizing claim cycle times and avoiding unnecessary litigation.

As part of the ICRS team, Misty upholds the firm’s core philosophy of being exclusively policyholder advocates, offering clients she represents a no recovery, no fee promise and delivering results that consistently exceed expectations. Her work contributes to the firm’s reputation for resolving over 90% of claims without unnecessary appraisal or litigation, a testament to her negotiation acumen and deep knowledge of insurance claim process.

Our Core Values

We Pursue the Truth

We Do What's Best for the Insured

We Win For Policyholders

We Act in Good Faith

We are Reasonable

We are Trusted and Respected

We don't take NO for an answer

Zero tolerance for B.S.

TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

Haidee J.

Client

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

James M.

Client

"I felt I could fully trust him..."

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

Katie H.

Client

"Scott negotiated to maximize our claim."

I definitely recommend ICRS! Scott and Misty went above and beyond to advocate on our behalf and help us navigate the nightmare of a large loss insurance claim. Scott has worked as a public adjuster for more than 15 years. He was extremely knowledgeable about the process, laws, and holding the insurance company accountable. The initial amount the insurance company agreed to would not have been enough to restore our property, and Scott negotiated to maximize our claim.

Julie Bug

Client

"They are truly a lifesaver!"

I cannot say enough good things about Insurance Claim Recovery Support — they truly feel like earth angels. Misty and Scott helped me through one of the most overwhelming and helpless times of my life. As a single woman dealing with major home renovations after a severe water leak, I was unfortunately taken advantage of by a dishonest contractor. From breaking my TV and not saying a word, to lying about repairs, damaging my sprinkler, inflating estimates with bogus charges, and even threatening legal action — I was completely overwhelmed.

That’s when Misty and Scott stepped in. Their knowledge of the laws and the insurance claims process is unmatched, and their compassion and support were exactly what I needed. They knew exactly how to handle the situation, empowered me with the facts, and guided me every step of the way. They genuinely listened, made me feel heard and understood, and stood by my side when I needed it most. I am beyond grateful for their integrity, expertise, and kindness. If you’re facing a tough insurance claim situation, do not hesitate to reach out to them — they are absolute professionals and true advocates and helped me feel safe in my own home again.

Katie H.

Client

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

not sure if you need help with your COMMERCIAL fire claim?

Frequently Asked Questions

What should I do immediately after an Commercial Building fire claim?

After a fire damages your property, take these critical steps:

Ensure everyone's safety and call emergency services

Contact your insurance company to report the claim

Document all damage with photos and videos before cleanup begins

Secure the property to prevent further damage

Save all receipts for emergency repairs and temporary relocation

Contact a licensed public adjuster before accepting any settlement offers

What qualifies as a "large-loss" fire claim?

A large-loss fire claim typically involves:

Extensive structural damage requiring significant repairs.

Business interruption losses exceeding $100,000.

Complex coverage issues with multiple policy provisions.

Commercial properties with specialized equipment or inventory.

Claims where the estimated damage exceeds $250,000.

Multi-level buildings or facilities with extensive smoke/water damage.

What if my fire damage claim was underpaid?

If you believe your fire claim was underpaid, you still have options: Most state laws and policy terms typically allow policyholders to reopen and supplement claims within two years A licensed public adjuster can review your settlement and documentation We can identify overlooked damages including smoke, water, and business interruption Our team can document additional losses and negotiate with your insurer We regularly increase settlements by 20% to 3,830% over initial offers We work on contingency, so there's no fee if we don't recover additional funds.

Can I dispute my fire damage claim payout?

Yes, you have several options to dispute an insufficient fire claim payout: Hire a public adjuster to document additional damages and negotiate on your behalf Request a formal claim review with your insurance company File a supplement claim with proper documentation of overlooked damages Request appraisal under your policy terms (we can represent you in this process) File a complaint with your State Department of Insurance As a last resort, pursue legal action with an attorney specializing in insurance claims.

Do I need a Public Adjuster if I have already received my settlement?

Yes, even if you have already received a settlement, a public adjuster can help determine if you were underpaid and whether you are entitled to additional compensation. Insurance companies often undervalue claims by overlooking damages, applying depreciation, or using restrictive policy interpretations. If your settlement does not fully cover the cost of repairs, you still have options.

Why Hire a Public Adjuster After Receiving a Settlement?

Settlement Review – A public adjuster can analyze your claim to ensure the insurance company accounted for all damages and provided a fair payout.

Supplemental Claims – If additional damage is found or your initial payout was insufficient, a public adjuster can negotiate for a higher settlement.

Reopening a Claim – Many policies allow claims to be reopened within a certain time frame, especially if new damages become evident.

Independent Damage Assessment – Insurance adjusters work for the insurance company, while a public adjuster represents your best interests.

When Should You Consider a Public Adjuster?

Your settlement does not fully cover repair costs.

You suspect the insurance company undervalued or missed damage.

You were told certain damage is not covered, but you are unsure if that is accurate.

You want an expert to handle negotiations and maximize your recovery.

It's best to act quickly with the best support by your side

Insurance policies often have strict deadlines for filing supplemental claims or reopening a claim. If you believe your hail damage settlement was too low, consulting a public adjuster could help you recover the full amount you are owed.

Get a Free Settlement Review Today.

TRUSTED PROFESSIONALS

Our Licences & Specialties

Agency Public Adjuster Licenses

Texas #1670060

Colorado #4472448

Ohio #1416560

Florida #W927993

NPN# 16144334

Misty's Public Adjuster Licenses

Texas #2647568

Florida #W798577

Kentucky #1267289

North Carolina #19846653

Nebraska #19846653

Ohio #1416569

Oklahoma #3001820951

Pennsylvania #1054792

South Carolina #19846653

Utah #915489

NPN #19846653

Haag Certified Commercial Roof Inspector #202111207

Scott's Public Adjuster Licenses

Texas - #1632488

Colorado #411678

Florida #W797805

Georgia #2874635

Indiana #3891955

Kansas #15827727

Kentucky #1014264

Maryland #2106190

North Carolina #15827727

Nebraska #15827727

Nevada #3508775

Ohio #1289475

Oklahoma #100118599

Pennsylvania #1043874

South Carolina #893766

Utah #915234

NPN #15827727

Haag Certified Commercial Roof Inspector #201408103

IICRC WRT Certified #229373

Our Large Loss Specialties

Apartment Complexes

Business Interruption

Commercial Buildings

Condominium Associations

Homeowner Associations

Homes

Historical Buildings

Industrial and Manufacturing Facilities

Office Buildings

Property Management Companies

Religious Organizations

Retail Centers

Schools

Storage and Warehouse

Fire

Flood

Hail

Hurricane

Lightning

Tornado

Water

Wind

Appraisal